To help our portfolio companies navigate through the current “fog of uncertainty”, we have decided to write a series of articles in which we’ll delve into the impact of the Covid-19 sanitary crisis on our areas of expertise: energy, mobility and industry 4.0.

Introduction

Recently, we delved into the impact of Covid-19 on manufacturing. We saw that key industrial players have been hit hard by the crisis and that they are digitizing at a forced march. But what about their involvement in green energy?

Until now, the renewables market was projected to grow rapidly; changing the way we fuel our cars, heat our homes and power our industries for decades to come. Yet today, the industry is facing headwinds as a result of the Covid-19 pandemic, the global economic downturn and the collapse in oil prices. The question is, will Covid-19 slow the global shift to renewable energy?

Quarantine period — Renewable energy has been the most resilient energy to Covid-19 lockdown measures so far

The International Energy Agency says energy demand is likely to fall by 6% in 2020 — seven times the scale of the drop suffered in the 2008 financial crisis. In other words, 2020 will be equivalent to losing India’s energy demand in absolute terms.

Despite it being the biggest shock since the Second World War, renewable energy has, so far, been the most resilient energy to lockdown restrictions, making up more of the energy mix. This is mainly due to the solar and wind projects that were completed in 2019 and to the priority dispatch of renewables over other energies, due to their low operating costs and favorable regulatory incentives.

But it goes without saying that the renewable energy industry was affected by supply chain disruptions and a slowdown in installation activity during quarantine.

- Solar energy: as Chinese factories account for 70% of the world’s solar panel supply, global production of solar photovoltaic (PV) was reduced in February due to factory closures in China’s key manufacturing provinces. Despite some shipment delays, production is now ramping up again.

- Wind energy: the wind supply chain however is very interconnected. As wind turbines require multiple parts across the world, Europe, which is a major manufacturing hub for wind turbines, suffered massively from China’s reduced production.

- Liquid biofuels: the liquid biofuels industry directly suffered from the decline in road transport fuel. US ethanol production was down nearly 50% by early April, leading to growing biofuel stocks, decreasing biofuel prices, thus compromising profitability. Many ethanol plants in fact shifted towards manufacturing hand sanitizer.

For small renewable energy suppliers, the situation was particularly difficult. According to Julien Tchernia, CEO of ekWateur, France’s leading supplier of renewable energy, the contraction in demand forced them to sell the excess of energy that had been contractually purchased (electricity can’t be stocked) at extremely low prices, making them lose a lot of money.

A decline in renewable energy additions due to delayed constructions and supply chain disruptions

Although Chinese factories are starting up, we expect global supply chain disruptions and delayed constructions to cause a significant dip in renewable energy additions. The procurement, construction and commissioning of new power plants will be slowed by the unavailability of work crews and the restrictions being placed on international travel.

- Solar energy: BloombergNEF has revised its global forecasts for 2020, saying that demand for photovoltaic solar panels will be in the range of 108 to 143 gigawatts, down from the range of 121 to 152 gigawatts that was forecasted less than a month ago.

- Wind energy: with the blustery start of the year and widespread wind turbine installations last year, we expect an overall increase in wind energy consumption. In China, all wind projects need to be commissioned by the end of the year to qualify for Feed-In Tariff subsidies. The United States is also in a similar situation. The question is: to what extent will there be delays?

- Liquid biofuels: we expect a decrease in liquid biofuels throughout 2020 despite a potential rebound of transport in S2 2020. Many biofuels blending mandates have been delayed especially with the decrease in low oil prices and the introduction of Brazil’s RenovaBio policy may also be disrupted.

- Hydropower: hydropower energy accounts for almost 60% of renewable energy yet remains the largest uncertainty in 2020 as it is dependent on rainfall and temperature patterns.

Beyond supply chain disruptions that will ripple through construction, construction projects will also be slowed by the depreciation of many currencies against the US dollar. Australia, Brazil, Mexico and South Africa are currently experiencing a rapid depreciation, resulting in higher capital costs for projects under construction. According to Rystad Energy, increases could be as high as 36% for these countries, resulting in the potential shutdown of most projects not yet been commissioned.

While analysts from BloombergNEF, PV InfoLink, and IHS Markit say that overall a significant contraction of demand is likely this year, some companies are reporting record sales with consumers reportedly panic-buying solar and storage equipment to sure themselves up in uncertain times. This is particularly true for Smart Energy, which has said it has witnessed a 41% increase in sales and a 400% increase in battery inquiries over Q1 2020. According to Elliot Hayes, CEO of Smart Energy, “our growth is a by-product of economic uncertainty that is driving both residential consumers and businesses to look for ways to future-proof their savings, homes and businesses.”

Towards a greener future?

As all projects for 2021 are being planned today, not all construction projects will go ahead as planned when the recession hits.

1. Towards a decrease in investment because of pressure on public and private budgets?

The government and policy-makers’ reactions to such a pandemic are hard to forecast. Whilst some countries may show resistance to change and slow the shift towards renewable energies, other countries may demonstrate an aggressive approach to accelerate the transition. Ultimately, the pace of the recovery and shift will depend on how governments direct their economic recovery spending.

Some countries like Spain have announced that Feed-in-Tariffs (FiT) would be extended, others have created new ones to boost the demand for renewable energy (e.g. the United Kingdom has announced new FiTs to boost the solar industry), whilst in some countries like the United States FiTs are fading.

Many argue that including incentives for renewable projects (tax credits, investment grants, loan schemes, etc.) should be a top priority in upcoming stimulus packages. In the EU, the €1 trillion Green Deal climate package, crafted before the COVID-19 outbreak, is now being touted as a critical part of economic recovery. Yet, one wonders whether climate commitments will take a backseat in economic recovery plans with investments in clean technologies being either abandoned or scaled down.

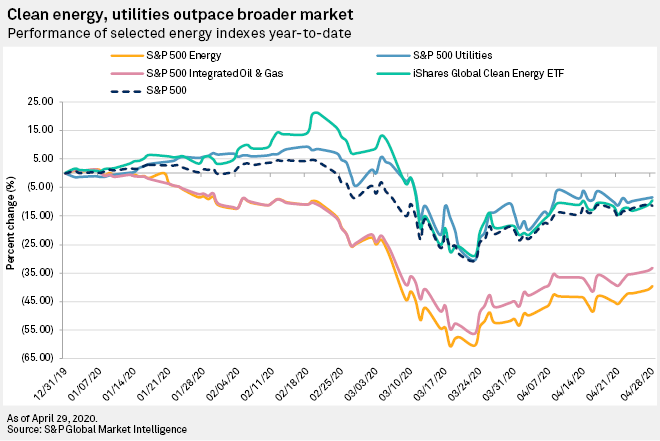

One thing is for sure: climate change and other environmental, social and governance (ESG) issues are being increasingly recognized as key determinants of a company’s future value creation potential. And renewable energy is demonstrating higher ROI than fossil fuels. According to a recent study carried out by Imperial College London and the International Energy Agency clean power stocks generated higher returns over the past 10 years, five years and this year — in the UK clean power companies such as John Laing and Ceres Powers have outperformed peers such as BP and Tullow over the past five years.

2. Will the lower oil prices affect renewable energy penetration?

Government policies have been forcing utilities to retire coal-fired power plants — since 2010, the net loss of coal capacity in the US has fallen by 102,000 megawatts. Yet, the recent decline in oil prices could lead countries whose economies are built on fossil economies to see a transition to cleaner energy as unnecessary.

In fact, the UK-based think tank InfluencyMap recently carried out an analysis on the corporates lobbying in the face of the Covid-19. It found that, large oil and gas players have been the most active in seeking for direct and indirect support (stimulus funds, pollution regulations and the use of the strategic petroleum reserve to bolster prices). As reported by Emily Holden for the Guardian beginning of May, records show that fossil fuel companies have already obtained $50 million in loans.

But despite the stimulus money and the weaker pollution regulations, the oil and gas industry is more vulnerable than ever. “The pandemic exposes and exacerbates fundamental weaknesses throughout the sector that both predate the current crisis and will outlast it” stated the Center for International Environmental Law (CIEL). Long before the crash in prices, the oil and gas industry has been projected to peak as external pressure has surfed — not only from environmental activists and regulators, but also from central banks and hedge funds — for the oil industry to diversify into lower-carbon energies.

In short, fossil energy may be cheaper now, but fossil fuel projects are becoming even riskier. With the increasing carbon-conscious investing and the worries that many fossil projects may become unviable, the lower prices are not an immediate threat to renewable energy. An indication: despite an oil price crash in 2014–2015, the renewable energy investment had a historic run.

3. The rise of a new momentum?

As said previously, without government action, this crisis could considerably disrupt the momentum around renewable energy. Conversely, with government support and carbon-consciousness, it could well be the start of a new momentum.

In fact, in Australia experts advocate that renewable energy may well drive economic recovery. According to Kane Thornton, CEO of the Clean Energy Council in Australia, “there is still a strong pipeline of renewable energy and storage projects and enormous customer demand for rooftop solar and batteries. These will be critical in replacing Australia’s aging coal-fired power stations, meeting Australia’s climate change targets and ensuring affordable and reliable power supply.”

With Covid-19, renewable energy has also gained new momentum in some countries and sectors. The transition to renewable energy has been slow in the mining industry yet even the remotest mines in Africa are now starting to consider solar, wind and energy storage. According to Alastair Gerrard, CEO of Zest WEG Group Africa, which supplies a wide range of electric motors, “the last year or two has seen a significant uptake in interest and securement of renewable energy power projects in the mining industry — which on a positive note is occurring across the African continent and not only in first world territories.”

Finally, technologies may well emerge from this crisis such as floating offshore wind farms, marine technologies and low-carbon hydrogen production. Recently Australia set aside $300 million to jumpstart hydrogen projects, the Netherlands unveiled a hydrogen strategy in late March for 500 megawatts of green electrolyser capacity by 2025 and a German hydrogen strategy is expected soon.

According to Antoine Huart, President of France Territoire Solaire, solar energy would be the energy pillar of resilience in the post New World — “produced by automated, digitalized, decentralized and abundant installations located in areas as close as possible to needs, solar energy seems to have been invented to meet the challenge of resilience.” Just as Europe has relocated lithium-ion battery manufacturing, it is questionable whether Europe will relocate solar manufacturing, since China accounts for 70% the world’s solar supply.

Conclusion

Although the shift towards renewable energy may have been slowed down, the long-term trend towards the transition to low-carbon energy will remain unchanged.

The future of the renewable energy industry will be shaped by: incumbent lobbying; consumer demand; the speed, quantity and nature of government support and the divestments and investments made (in other words, will fossil fuel investments be divested to be invested in renewable energy?).

It is, therefore, essential that countries put renewable energy at the forefront of their recovery plans to build towards a more sustainable future — before the next climate-induced event triggers another global economic shock.