To help our portfolio companies navigate through the current “fog of uncertainty”, we have decided to write a series of articles in which we’ll delve into the impact of the Covid-19 sanitary crisis on our areas of expertise: energy, mobility and industry 4.0.

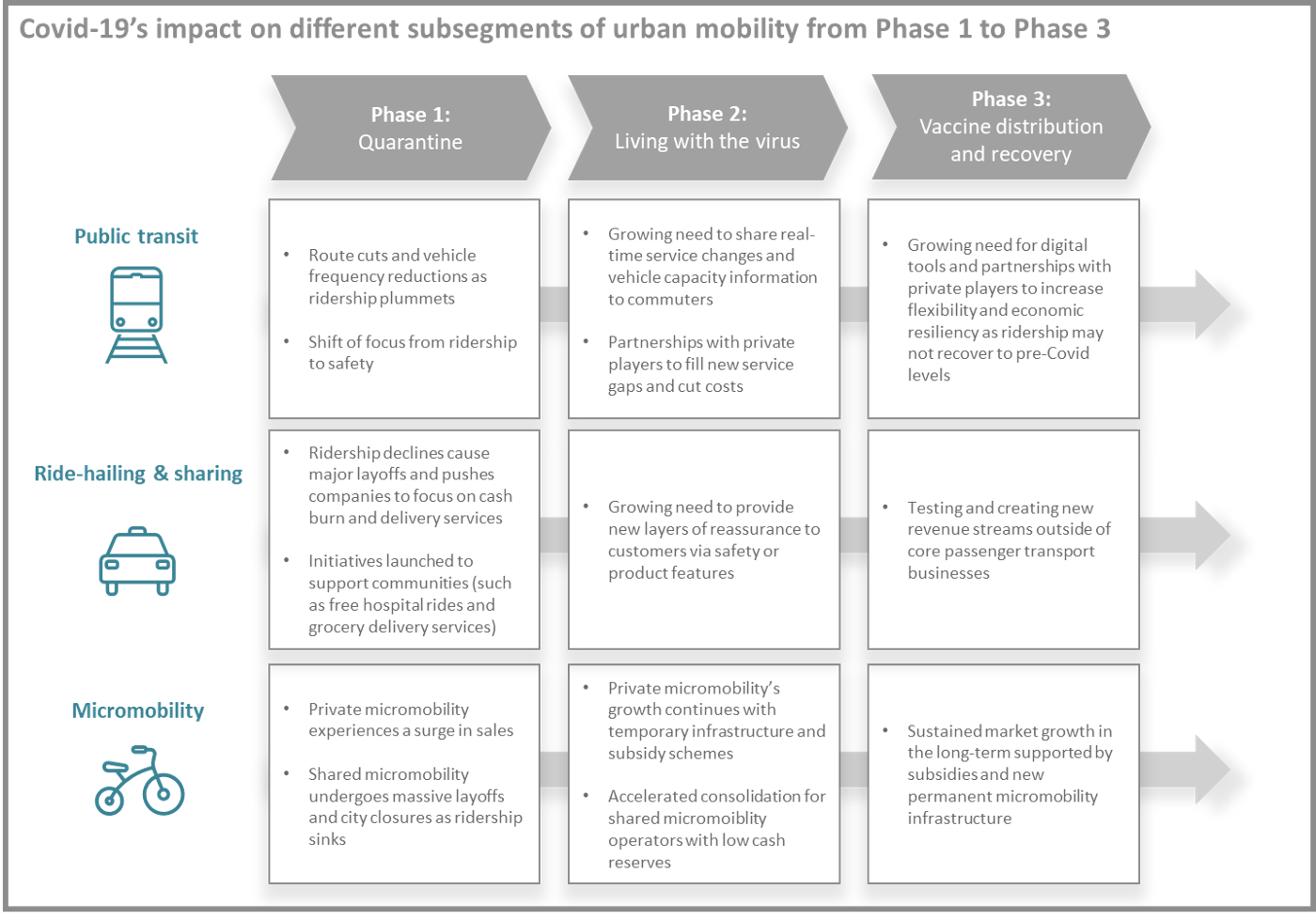

In these articles, we will analyze the impact over three different periods identified in our first article:

- Quarantine period — Fighting through the sanitary crisis (10–15 weeks in the UE)

- Safe-mode period — Learning to co-exist with Covid-19 (after quarantine)

- Period of recovery — Development and distribution of a vaccine at large scale (from 2021)

Urban mobility, like many industries, looks remarkably different today than it has in recent times. Traffic levels from March of this year were nearly the same as they were in March of 1999 in the US. In Europe’s five largest economies, traffic is slowly climbing as lockdown measures have been lifted, but as of mid-May it remained 40% below levels from January 13th.

Commuters have reduced or stopped moving, and as a result, public and private urban mobility players have been forced to adapt or halt business altogether. But how have different subsegments of urban mobility been impacted so far? What changes have we seen in public transit, ride-hailing and carpooling, and micromobility? How will Covid-19 reshape urban mobility?

Phase 1: Fighting through the sanitary crisis

Covid-19 has hit all forms of shared urban transportation hard. Now that many western economies are beginning to reopen and ease lockdown restrictions, let’s take a brief moment to review how the crisis unfolded for different subsegments of urban mobility:

1.1 Public transit experienced rapid ridership declines and growing safety costs

In the pre-Covid days, transit agencies were putting a strong emphasis on increasing ridership and improving traffic congestion. This focus quickly shifted in March and April, as operators instead rushed to ensure safety for commuters and staff. According to Jonathan Simkin, the CEO of Swiftly, a leading enterprise software provider for public transit agencies and an Aster portfolio company, “We immediately saw agencies encouraging people not to take transit unless the trip was essential, and the industry saw a ~75% decline in ridership [in the USA].”

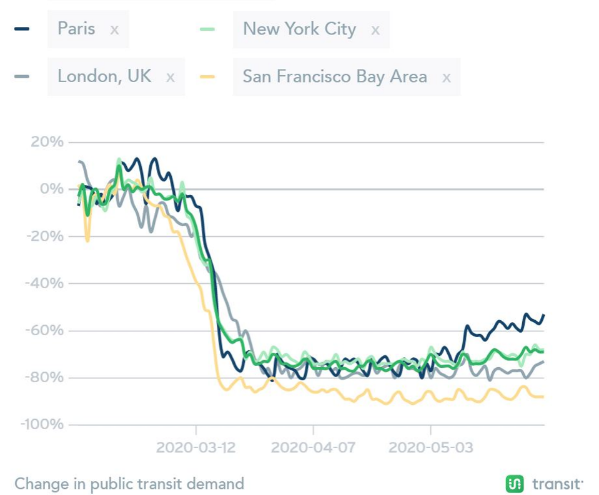

Public transit demand declines across London, New York City, Paris and the San Francisco Bay Area. Source: Transit app

Transit agencies have been placed in a precarious position because of growing safety concerns and falling ridership, which has led to significant revenue cuts. In a matter of days, they rushed to modify and cut routes, secure personal protective equipment, and implement new cleaning policies, while simultaneously providing services for essential workers who depend on public transit.

1.2 Ride-hailing and carpooling players also saw ridership plummet

Ride-hailing giants were also hit particularly hard just as their paths to profitability were starting to clear. Lyft and Uber experienced year-over-year ridership falls of 75% and 80% in April, respectively, and Ola saw their revenue decline by 95% over two months. These dips in demand and revenue led to several large rounds of layoffs to reduce cash burn, and forced these players to focus on developing other revenue streams, such as delivery services for food and essential goods.

We also saw companies in the space launch free initiatives to help communities adapt to Covid-19. For instance, Karos, a European carpooling leader for short-distance rides and an Aster portfolio company, devoted 100k free rides to hospital workers in Paris to make their lives a little easier. BlaBlaCar launched BlaBlaHelp, an app with no service charges to support communities with grocery shopping during the crisis.

1.3 While shared micromobility was essentially shutdown, personal micromobility experienced rapid growth

Covid-19 came at a complicated time for shared micromobility. The industry was already struggling before the virus to establish positive unit economics with cash intensive business models, and it is crucial for shared micromobility operators to meet specific utilization thresholds to have a shot at profitability.

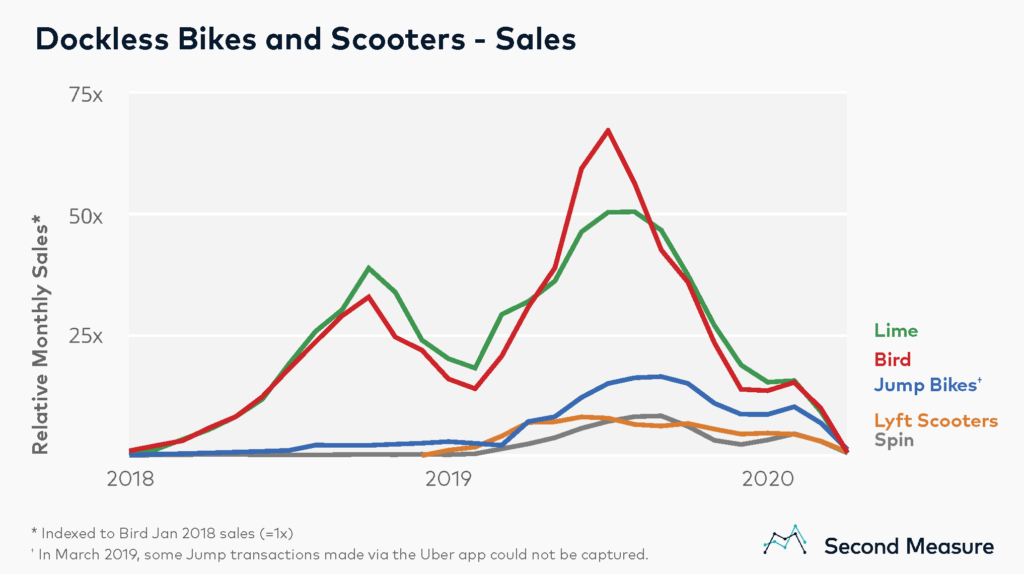

Source: Second Measure

Shared micromobility players were forced to suspend operations. “For micromobility in general, everything grinded to a halt…just as it did for most businesses,” noted Colin Roche, who is the CEO of Swiftmile, a smart charging platform for shared and private-owned micromobility vehicles. Industry leaders such as Lime, Bird, Voi and Tier quickly suspended operations across many markets, making the objective of reaching positive unit economics dramatically more difficult.

Personal micromobility, however, has had remarkable traction because of the crisis. Bike sales boomed in the UK as commuters tried avoiding risks associated with public transit or shared micromobility. Moving forward, the bike market is projected to get a huge boost from the virus, with several road-bike categories potentially increasing 35% this year, compared to 6.9% growth in the global bicycle market in 2019.

Phase 2: Safe-mode period — Learning to co-exist with Covid-19

2.1 Public transit must digitize and continue partnering with private mobility players

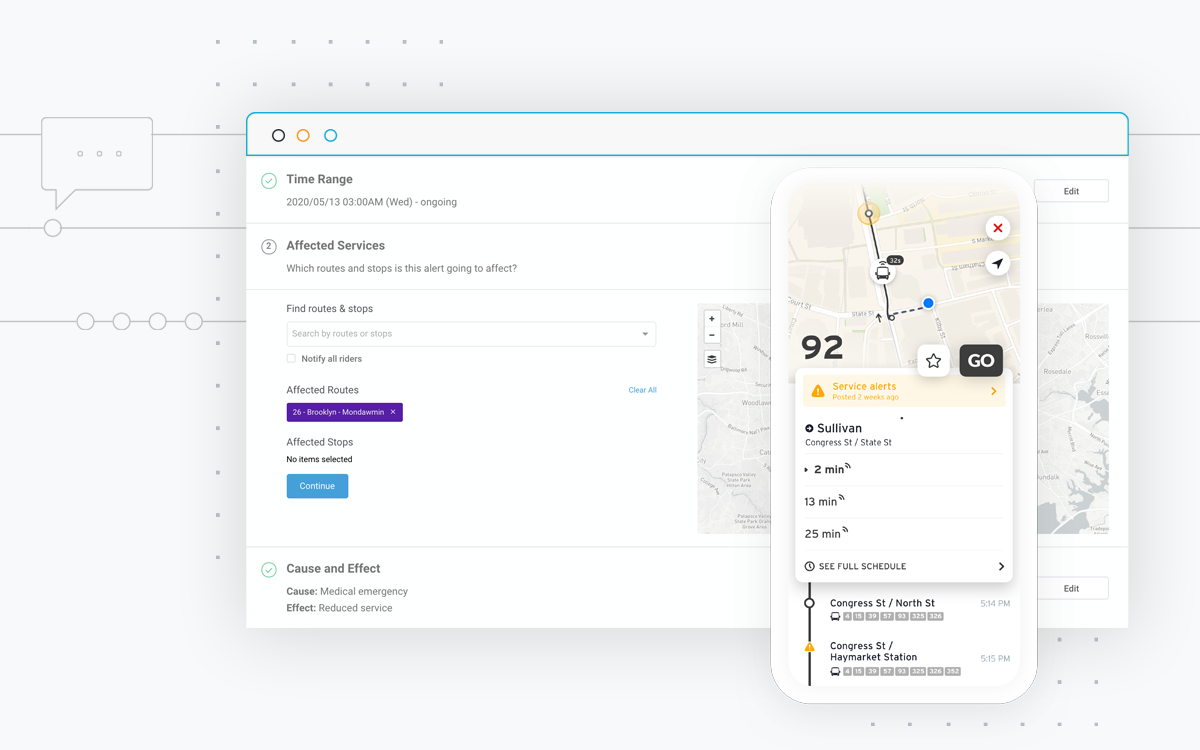

Many transit authorities are struggling with legacy tools to match service changes with fast changing commuting patterns, and Covid-19 has accelerated the need for agencies to adopt new tools to streamline workflows and enhance overall efficiency. “I think the biggest change is that the industry will need to undergo 5 years of digital transformation in just a few weeks,” shared Jonathan from Swiftly. “Updating schedules used to be a multi-month process that occurred 2–4 times per year. That’s now happening on a weekly and bi-weekly basis…Likewise, analyzing data to determine what network changes to make used to take months… it now needs to take days.”

Digital tools will also be critical for agencies to communicate to staff and riders. As Covid-19 continues to alter passenger demand patterns, agencies will need to revitalize the way they inform people about service changes and interruptions. Swiftly recently launched Rider Alerts free of cost to agencies to improve the way they communicate service interruptions to riders.

Providing real-time vehicle capacity information will be paramount for agencies. Commuters are increasingly aware that mass transit could pose higher virus transmission risks due to crowding compared to other forms of urban mobility. To regain trust from lost commuters, agencies will need to leverage tools to share real-time information with riders about whether a specific bus or tram has enough space to adhere to social distancing measures.

Partnerships with private mobility players will likely accelerate to fill service gaps and cut costs. The crisis has spurred transit agencies to partner with private players to quickly fill transit gaps and reduce costs. For instance, several agencies in the US including Miami-Dade began subsidizing ride hailing platforms to reduce the costs of running empty buses during off-peak hours. We expect additional partnerships to emerge between public and private mobility players to help support resource-strained transit agencies in the months ahead.

2.2 As ridership recovers, ride-hailing and ridesharing players will continue their hunt for new layers of safety and reassurance for riders

While the consumer shared ride business was hit hard in the quarantine phase, early signs show ridership recovery as economies begin to reopen. “We have a clearer view now that things are going in the right direction. We recently conducted a survey with 4.5 thousand respondents, 70% of which want to carpool at least at the same level or even more than before [Covid-19],” highlighted Olivier Binet, CEO of Karos. The industry is indeed seeing a gradual recovery in the early weeks of phase 2, with rides on Lyft increasing 26% in May compared to April. Uber also reported modest growth in terms of trip requests in May compared to April.

To improve ridership as economies reopen, ride-hailing and sharing players will need to provide extra layers of reassurance through new features, such as Karos’ “Favorite” (link in French), which lets riders create a list of their preferred carpoolers to make them feel more comfortable riding again as lockdowns ease.

2.3 Private micromobility emerges as an attractive alternative, while shared micromobility sees gradual usage rebounds and accelerating consolidation

Private micromobility will likely be the winner of urban mobility in phase 2, and will stand as a compelling alternative for commuters who have been encouraged to avoid public transit and carpooling. Major online retailers are sold out of many e-bike models, and e-bike manufacturers like VanMoof now have waiting lists lasting four or five weeks. Private micromobility is also supported at the government level in several European markets including France and Italy, where subsidy schemes have been implemented to help individuals repair or purchase their own micromobility vehicles.

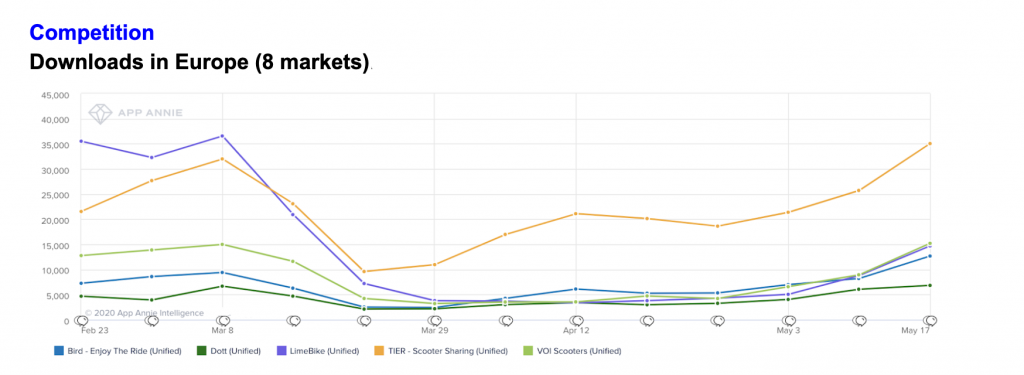

Shared micromobility usage is rebounding from steep lows. Several operators have reportedly claimed usage rebounds as lockdowns have eased across the EU, such as Tier, which experienced usage levels similar to what they were seeing in October 2019, or Dott, which saw scooter usage climb above pre-Covid levels. “It makes sense given that people will avoid enclosed spaces like Subways, Trains, Ubers and want to preserve social distances and stay outside in the fresh air. As a result, cities are now looking at Micromobility as an essential mobility option for transit, as opposed to a “nice to have” option like they did prior to Covid-19,” added Colin from Swiftmile.

However, reaching “normal” usage levels will be a significant hurdle. Shared micromobility is a highly seasonal business, and the summer is the industry’s time to shine. With more people working from home and a very real probability of less commuting compared to pre-Covid times in the coming months, the industry could face significant challenges to reach new highs this summer while also paying for sunk hardware costs.

Consolidation in the shared micromobility space was already well underway before Covid-19 with a growing list of M&A activity including Bird’s acquisitions of Scoot and Circ, and the creation of Grow Mobility from the merger of Grin, Ride and Yellow.

Covid-19 will likely accelerate consolidation for shared micromobility, and established ride-hailing and sharing companies have already begun strategically investing or partnering with leading micromobility companies. Just last month, Uber led a $170 million round in Lime, a round in which Lime also took control over Uber’s Jump business. BlaBlaCar announced its expansion into shared micromobility in France by partnering with Voi. In the months ahead, we expect operators with low cash reserves to join forces with their counterparts, raise new funding rounds with significant valuation haircuts or go out of business.

Phase 3: Period of recovery — Development and distribution of a vaccine at large-scale

3.1 Public policy could play a key role in shaping the new normal for urban mobility

Governments were already implementing sustainable urban mobility policies before Covid-19, but the virus will likely expedite these policies. Preceding the outbreak, France passed the Mobility Orientation Law to accelerate carbon neutrality for land transport. A piece of this law now makes it possible for companies to reimburse purchases of bikes and all other green means of transportation for their employees free of tax (fixed at €400 euros per year per employee). This law was initially set to be in effect on July 1st of this year but was expedited and became effective on May 11th to help limit the traffic congestion following the end of the lockdown.

3.2 Covid-19 has accelerated the ongoing need for digitalization in public transit

Public transit will be significantly impacted by the virus. Early estimates forecast €40bn in losses for European public transport in 2020 and $8.5bn in losses alone for New York’s Metropolitan Transportation Authority. That said, public transit is clearly an essential service, and despite the health concerns and growing financial constraints, it will continue to play an integral role in moving people.

But Covid-19 has undoubtedly exposed many of public transit’s pain points, such as frequent schedule changing, employee training, overall service efficiency and reliability. With a real probability of fewer riders and growing financial pressure lasting months or potentially years, it is now more important than ever for transit agencies to push harder in their digital transformation efforts and adopt new cost-efficient tools that provide more flexibility as commuting patterns continue evolving in the months and years ahead.

Moreover, public transit will need to become more interconnected to help complement fixed routes. This will require agencies to push away from legacy players that are incompatible with other applications that drive innovation forward. “On our end, we’re investing heavily in allowing transit agencies to shift away from legacy tools prone to vendor lock-in and data siloes. We’re pushing hard to create an open digital infrastructure with data standards and APIs,” added Jonathan from Swiftly. “By making transit data more open and accessible, we can start to foster unique and innovative connections between services, like better connecting mass transit with on-demand transit from another provider. Ideally these systems could talk to one another to drive overall efficiency across the network as a whole without looking at a single mode in isolation.”

3.3 Ride-hailing and ridesharing players will continue developing and testing new revenue streams outside of their core business in order to survive

With a cloudy crystal ball as to when exactly ridership levels will return to normal, ride-hailing and sharing companies will be pushed to make additional investments in new products, features or services providing different revenue streams to help navigate through the turbulence. If usage remains lower in the months to come, we can expect to see additional moves beyond the aforementioned investments in food and essential good delivery services, such as Uber’s Work Hub, a platform within the Uber app providing their network of drivers with work opportunities both in and outside of the company.

3.4 Micromobility 2.0 — market growth supported by new infrastructure and more sound pricing models

Micromobility will grow in the long term as public authorities begin creating the necessary policies and infrastructure. “The new ‘norm’ will be riding shared scooters, ebikes and walking much more than the pre-covid times,” added Colin from Swiftmile. Indeed, many cities have used Covid-19 as an opportunity to push micromobility as a viable alternative to adhere to social distancing as economies begin reopening. For instance, cities including London, New York, Paris, Rome and Seattle have either temporarily or permanently closed streets to cut through traffic, which has created more space for micromobility.

Shared micromobility operators will fine-tune their pricing models. In the years to come, micromobility players will experiment with pricing strategies beyond the per minute pricing industry standard. While building more robust hardware and software will undoubtedly play a key role in making shared micromobility profitable, we expect operators to upgrade their pricing models to better reflect the value that riders derive from their services. Some new ideas on this front are already being tested, including loyalty programs, unlimited use subscriptions and privatized rentals on a weekly or monthly basis.

Conclusion

While uncertainty remains with respect to length and long-term impact of the crisis, there is bound to be some enduring change to the urban mobility landscape precipitated by Covid-19:

For now, one of the big unknowns is how consumer demand will recover for urban mobility in the months and years to come. The unanswered question is how many trips will be replaced by virtual work and entertainment once this is all done?