Investing Today, Together, for a Carbon-Conscious Tomorrow

Net Zero Ventures 1 was born out of our commitment to decarbonize the most polluting sectors by supporting innovations that shape a greener future.

The fund was born out of our commitment to decarbonize the most polluting sectors by supporting innovations that shape a greener future. With over 20 years of investments in ClimateTech, we believe in the unique opportunity that this historic moment presents, both for our planet and our portfolio.

Today, the need for decarbonization solutions is more urgent than ever, and investors and regulators are turning towards technologies that can provide tangible and measurable responses to global climate challenges. With €2 trillion allocated to next-generation greenhouse gas reduction technologies by 2025, the era where growth was prioritized over sustainability is coming to an end.

In this context, we are thrilled to introduce our 5th fund, Net Zero Ventures I. This fund is dedicated to investing in Climate Tech startups focused on decarbonizing the most challenging sectors, with the aim of achieving significant reductions in global emissions. Our goal is clear: to avoid 500,000 tons of CO2eq for every €10 million invested.

Our commitment lies in seizing short-term opportunities to deliver tangible impact within a timeframe of under 5 years to accelerate systemic change.

Our thesis

Net Zero Ventures I is a Climate Tech VC fund specialized in hard-to-abate sectors:

Energy

Buildings

Industry

Transport

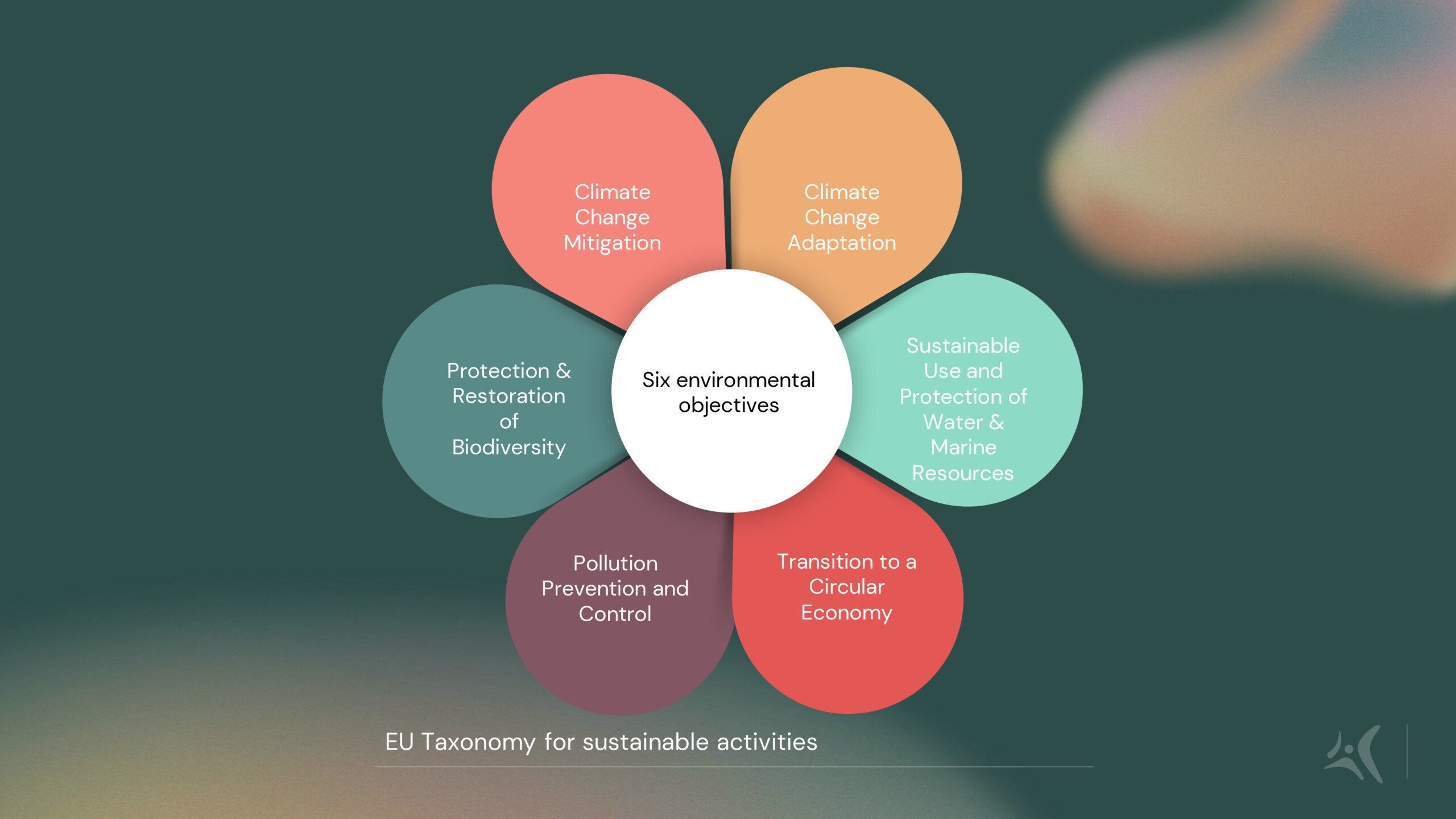

Decarbonization: it encompasses startups offering products, services or technologies that tackle at least one of the 6 main goals in the EU Taxonomy for sustainable activities

- Impact timeframe: <5 years

- Geography: 85% Europe, 15% rest of the world

- Stage: Seed-Series A

- Ticket size: 0.2M to 2M€

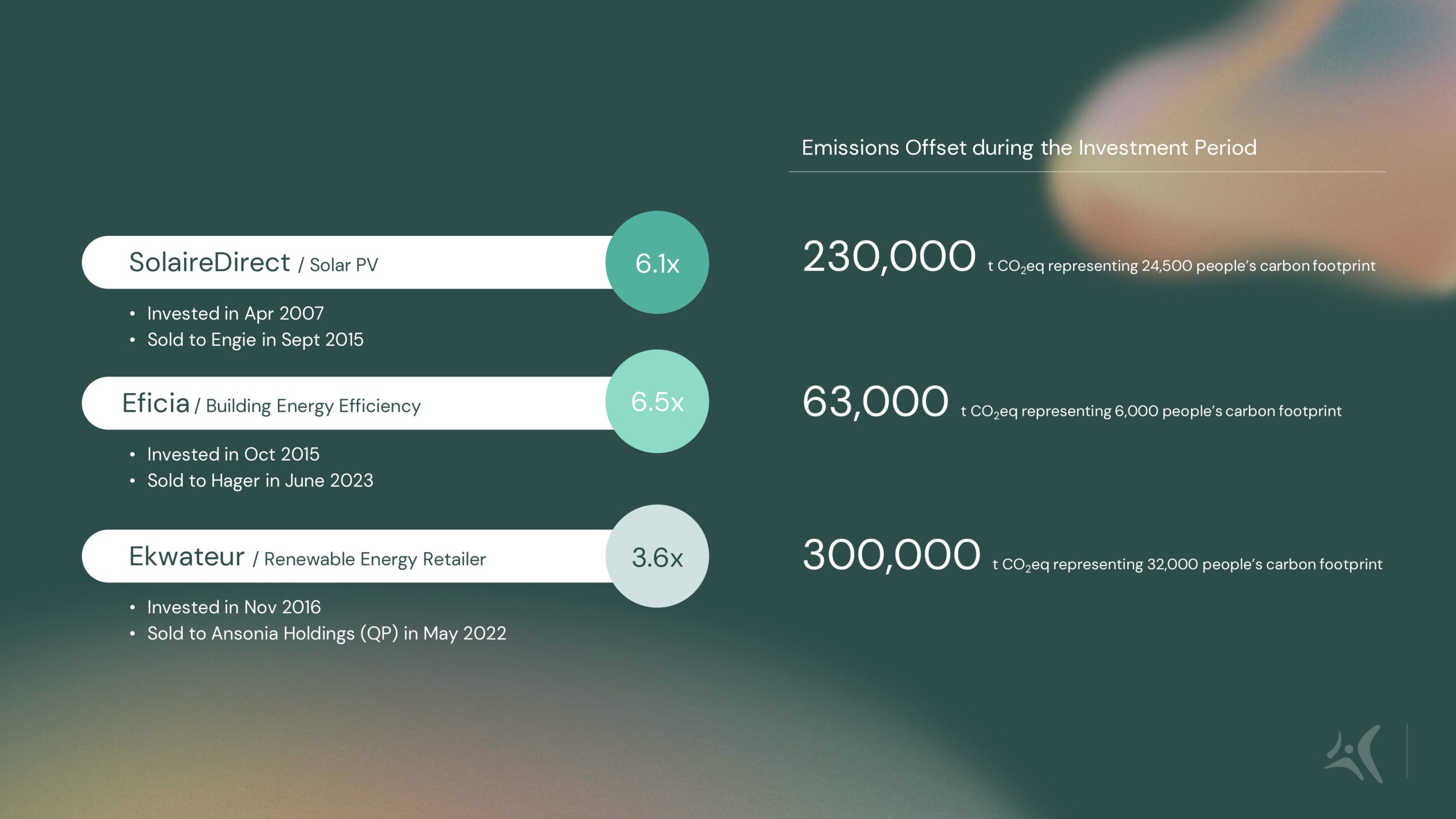

Building on our Climate Tech track record

With €2 trillion allocated to technologies aimed at reducing next-gen greenhouse gas emissions by 2025, the era of prioritizing growth above all else is coming to a close. We’re crafting a customized approach that connects venture capital with benefits of sustainable transformation.

With a 25-year track record in Climate Tech investments (request details) through Aster funds, we are convinced of the growing momentum in financing startups focused on carbon-first solutions.

Article 8 Impact Fund

Net Zero Ventures I is an Article 8 impact fund designed to invest in companies and technologies that contribute to achieving net zero carbon emissions.

A unique community

Our fund leverages the power of community to foster collaboration from startup scouting to scaling, for a greater global impact.