Seed/Series A startups and corporates are fundamentally different beasts.

The two usually operate on completely different wavelengths on several fronts:

- Inherently risk-prone vs. risk averse

- Quick vs. slow decision-making cycles

- Needs cash to survive vs. cash matters, but not at the same scale

So it’s no wonder that fostering a successful collaboration is often challenging and unfruitful when a startup is looking to engage with corporates.

Yet, as a B2B SaaS startup, landing business with corporates is a matter of survival. But how do you identify and connect with the right corporate client? How do you get your foot in the door? How do you improve your odds when it comes to converting pilots into long-term partnerships?

Having fostered a great deal of partnerships between startups and corporates here at Aster, we’ve decided to share a few tips to help founders at the Seed/Series A stages optimize their sales efforts and make the most out of their relationships with large corporates.

1. Target the right companies — it’s NOT a numbers game

If you are selling SaaS to mid-market companies and large corporates, chances are you have many potential targets. Given the low conversion rates, there is a tendency to believe that the best way to land deals is to maximize the number of companies you engage with.

But it is important to consider that large corporates have different and generally more complex approaches when it comes to working with startups. For large companies, a Proof of Concept (PoC) is a must before scaling a startup’s solution within their organization, while mid-market companies take more of a “self-service” approach, moving more quickly from trial periods to commercial contracts.

Some growth hacking tricks (LinkedIn bots, mass email campaigns…) are quite efficient for automating the cold outreach process. However, early discussions with corporates can’t be automated.

With that in mind, the best way to maximize your conversion odds is to precisely define your ideal target, and to select corporates that are most likely to answer positively to your offer.

In a nutshell, your target should meet the following criteria:

1. There must be an identified use case

How badly does the company need a solution like yours? Is this pain point expressed? If so, is it shared by many people within the company? If not, why do you feel there is a need? Is this need measurable?

2. The timing must be right

Is the corporate governance stable? Is your solution category already in your target’s radar? Are they culturally ready to work with you? Are they receptive to the idea, or do they require a huge mental shift to considering purchasing? Has the company recently engaged in a multi-million-dollar project that could be competing with your solution?

3. There must be an existing budget

Does the company have the necessary funds to buy what you are selling? Where is the company in their budget cycle?

Knowing this in advance will help save time and avoid frustrating conversations.

2. Dissect the corporate black box: map out the organization, decode and understand your stakeholders’ interest

As a founder, chances are that most of the time you will have only one point of entry into the organization (let’s call him Bob).

If Bob has expressed an interest to test or buy your product, congrats! But Bob will rarely be your only customer or user within the corporate. It’s also unlikely that he’ll be able to commit to buy your product on his own, and even less likely that he’ll oversee the integration of your product into legacy systems.

In reality, going from your first conversations with Bob to the ideal roll-out of your solution throughout the company will involve several decision-makers — all of whom have different interests, agendas, expectations and fears.

The solution? Mentally break up the large corporate into bite-sized chunks. It will make it easier for you to identify the gatekeepers and then turn them into gate openers.

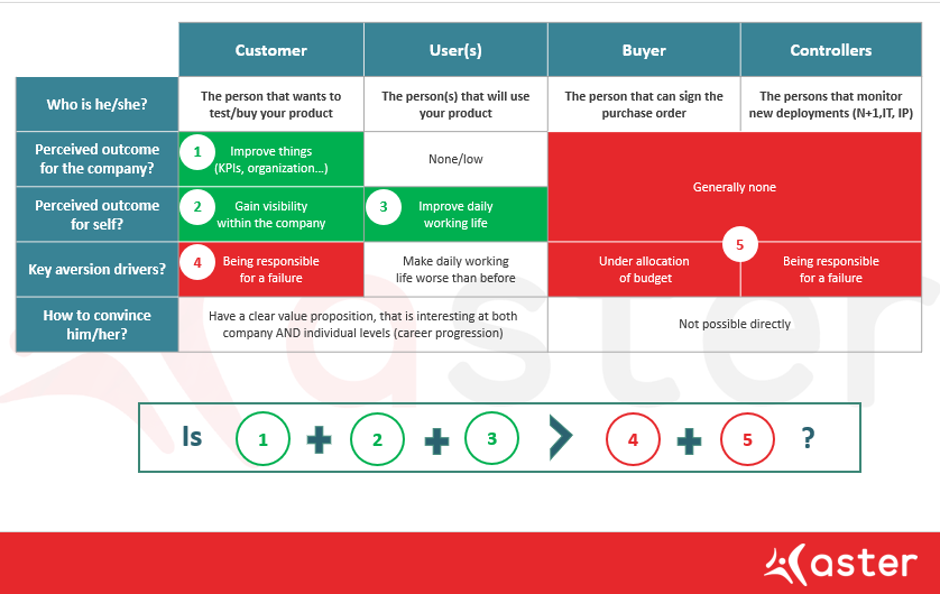

Here is a simplistic scorecard of the different gatekeepers and their own interests:

Source: Aster Capital

Basically, the idea here is that you’ll succeed in selling your product to the customer if the perceived value of your solution outweighs the risk of it being a failure or leads to poor cash allocation. And when this happens, you may even find internal champions — who truely believe in your product — and will do most of the heavy lifting for you!

3. Once you have a foot inside the corporate door, focus on delivering a strong value proposition

Weak value propositions kill sales. It is essential to build and deliver a compelling value proposition that convinces clients to work with you. To do this:

1. Be clear and specific

Your value proposition should be compressed into one quick and convincing message to avoid wasting time for yourself and the decision-makers within the corporate.

2. Talk about results, not aspects

Focus on quantitative information (time saved, reduced effort, costs cut, revenue generated…). It’s all about focusing on problems, benefits and opportunities.

3. Demonstrate customer-specific value

Get to know your company (industry trends, how they are responding to them…), speak their language and show that you’re here to help solve their problem.

Signing PoCs is one of the most common ways to engage with large corporates. It is often cheap/free, requires little IT integration and requires limited commitment from all the stakeholders involved.

But it is essential to remember that you are not a PoC company. Your endgame is to sell valuable, scalable and reputable products to your customers, and you are subject to financial and time constraints in this process.

Even if a PoC is mandatory to engage with a large corporate, always consider it as a stepping-stone to roll out your solution at scale.

Here are some tips for startups on how to convert PoCs into commercial contracts:

1. Before signing the terms, check your potential client’s interest in a post-PoC relationship

A key indicator of a company’s interest is if they discuss how to scale and integrate your solution in their day-to-day business, not just the KPIs for PoC. A best practice here is to negotiate a 12-month contract that begins with a 3-month trial period (the PoC) with an option to opt out if KPIs are not met (but if they are, the PoC is converted directly). But be careful! Startups are not consultants. So try to include clauses in the PoC contract to avoid excessive customization requirements.

2. During the PoC show that the pre-established KPIs are being met

3. At the end of the PoC provide the company with a brief summary that highlights the benefits of the PoC — quantitative and qualitative — and help the customer plan a large-scale deployment

Selling to corporates is challenging due to organizational inertia (large size of the structure and the complex decisions-making processes) and risk aversion, especially when you’re an early stage startup with few business developers and no relationships with third-party integrators whatsoever.

May the force be with you!