Dozens of start-ups have emerged over the past few years boldly announcing we have the technology; flying cars are here (or almost). Serious money is being thrown at electric and hybrid aviation, and credible backers are not lacking. Even the incumbent aircraft manufacturers are backing start-ups and launching their own in-house development programs. At the same time, the detractors say yes, maybe one day we’ll fly electric, but not anytime soon, mostly due to limitations of current battery performance.

Over the past 30 years I’ve experienced some fundamental industry transformations as a banker, investor and entrepreneur. I’ve seen technology innovation fundamentally transform massive industries such as telecommunications, computing and energy.

Today, I am seeing the signs of such a transformation in aviation. This article looks at the background to electric aviation, the challenges it faces today, and some indications about where attractive investment opportunities are likely to emerge.

1884: Electric Airships

It is well known that the electric car made a brief appearance at the beginning of the 20th century, only to be overwhelmed by the superior performance range of gasoline-powered vehicles.

Less known is the fact that the first powered flights were electrically powered and with Vertical Take-Off and Landing (eVTOL) capability The first powered aircraft, the dirigible “La France,” flew an 8 km trip around Chalais Meudon in 1884, using bespoke electric motors powered by a zinc-chlorine battery with an energy density of around 30 Wh/kg. Despite a series of successful flights, the aircraft’s range was too limited by its batteries to be further developed, and the glory days of the Zeppelin era were powered by diesel. Gasoline and other oil derivatives have reigned over aviation ever since.

Source: Public Domain

Why? Because fossil fuels simply pack in so much more energy than batteries for a given weight and aircraft range is highly sensitive to the energy density of its propulsive fuel, as described by the Breguet range equation. Electric “fuel” is further disadvantaged compared to conventional fuels because batteries do not lose weight as they discharge, further reducing range compared to combustible fuels.

1973: Electric Airplanes

It was not until the first oil crisis that electric powered aircraft made its reappearance: in October 1973 the first electric airplane (fixed-wings) flight took place in Austria based on a repurposed glider and was powered by VARTA nickel-cadmium batteries and a Bosch electric motor (borrowed from a forklift). The flight lasted for 14 minutes and achieved an altitude of 360 meters. As the oil crisis abated, so did interest in electric aviation. Only half dozen or so electric airplane projects had flown by the end of the last century.

Source: HB-Flugtechnik

In more recent times, an important catalyst for the revival of electric aviation has been NASA’s Centennial Challenges program, a series of innovation prizes launched to mark the Centennial of the Wright Brother’s first powered airplane flight in 1903. In particular, the Green Flight Challenge, designed to push the limits of energy efficiency of flight and which featured the largest cash prize ever awarded in aviation history (total purse of $1.65 million, sponsored by Google), drew 14 entrants. The challenge was to fly 200 miles in less than 2 hours using less than a gallon of fuel (or energy equivalent) per passenger. In 2011, the contest was won by the Slovenian Pipistrel flying an all-electric airplane, using lithium polymer cells with an energy density of 173 Whr/kg. Pipistrel remains one of market leaders for electric light aircraft and is currently developing an eVTOL (as a partner of the UBER Elevate initiative).

Source: Pipistrel

The Green Flight Challenge illustrated that electric aviation had come of age; and that battery technology and electrical propulsion systems had become sufficiently performant, at least for small electric aircraft.

2009–11: Electric Helicopters

Vertical take-off and landing aircraft are more demanding on power sources than conventional aircraft, which benefit more from the forces of lift to stay aloft. It was not until 2009 that a fully electric helicopter was developed and flown in 2011 by Pascal Chrétien and Solution F in France, as a demonstrator. The aircraft was powered by Kokam lithium cobalt pouch cells which had an energy density of 160 Wh/kg. So even for helicopters, battery technology had reached a degree of maturity sufficient at least for short flights.

Source: Solution F

Flying Cars, electric and hybrid airplanes

These clear demonstrations of the capabilities of electric propulsion and battery performance heralded a new era in aviation and drew entrepreneurs, capital and new ideas to the sector, many driven by a “clean tech” ethos. For example, Joby Aviation (“…advancing the transition to sustainable aviation”) was founded in 2009, Kitty Hawk in 2010 (“…we will improve our urban and natural environments with efficient and reliable mobility”), Volocopter in 2012 (“a green helicopter”), and Zunum in 2013 (“…get anywhere fast, and leave behind a healthy planet”).

Some of the incumbent manufacturers took notice of the potential of electrification around this time as well. Sikorsky (now part of Lockheed Martin) attempted to retrofit an existing product, replacing the thermal engine with an electric motors and batteries. And at the end of 2010, a “skunkworks” project was initiated at AgustaWestland in Italy (now Leonardo) to develop a fully electric tiltrotor eVTOL as a technology demonstrator. After test flights in 2011, the aircraft was revealed to the public in 2013. Airbus developed a 2 seater all electric demostrator (the “E-Fan”) which flew in 2014.

During this period played a key role in promoting the idea of electric and distributed propulsion, releasing several conceptual designs and funding a sub-scale tilt-wing hybrid demonstrator (“Greased Lightning”) which flew in 2015.

Drones

And another force came into play during this period: drones. As consumer drones increased in capability with better batteries and higher payloads, the commercial potential became apparent. New markets in aerial photography and surveying, inspection, agriculture, and security have been evolving quickly, and market overlap with helicopters is already apparent. Off-the-shelf drone technology also allows the rapid prototyping of new eVTOL concepts, and the push for delivery drones is forcing regulatory bodies to put in place air traffic management systems — which will be essential for the eventual deployment of “flying cars”.

UBER Elevate

Perhaps the biggest catalyst for electric aviation has come from the UBER Elevate initiative. Launched by the publication of a White Paper in 2016, UBER proposed to develop an ecosystem for urban air mobility as an extension of its existing “on-demand” ground mobility services. Subsequent conferences and industry gatherings have fleshed out a full vision of the ecosystem and design requirements (eVTOL common reference models) have been published. UBER has engaged closely with aircraft manufacturers (including EMBRAER, BELL, BOEING/Aurora, Pipistrel and KAREM) and the cities of Los Angeles and Dallas-Fort Worth, with the aim of launching commercial operations in 2023. UBER’s vehicle requirements will only accommodate fully electric aircraft and vertiport specifications do not allow for combustible fuel.

The promise of a huge market facilitated by UBER has drawn dozens of new entrants into the market since 2016. The website evtol.news keeps a running tab of eVTOL projects and start-ups — there are 167 of them listed as of May 14 2019, and many innovative designs are emerging.

Source: Neoptera

Big Questions remain

Above all, it’s about the performance of batteries. If it took engineers over one hundred years to progress from 30 Wh/kg to 160 Wh/kg, how long is it going to take to make the next leap? Aviation fuel (Jet-A) has an energy density of 11,000 Wh/kg!

The answer is that such a leap might not be necessary. Electric motors are inherently more efficient than thermal engines, by as much as a factor of 2. Moreover, electric propulsion scales linearly, enabling distributed propulsion. Distributed propulsion allows better airframe designs with superior lift/drag ratios than conventionally designed aircraft.

Hybrid designs, especially where a generator is used to power distributed electric motors, can allow aircraft to benefit from some of the advantages of distributed propulsion, and obtain longer ranges or higher payloads without having to wait for battery technology to improve. Zunum in the US and Voltaero in France are taking this approach.

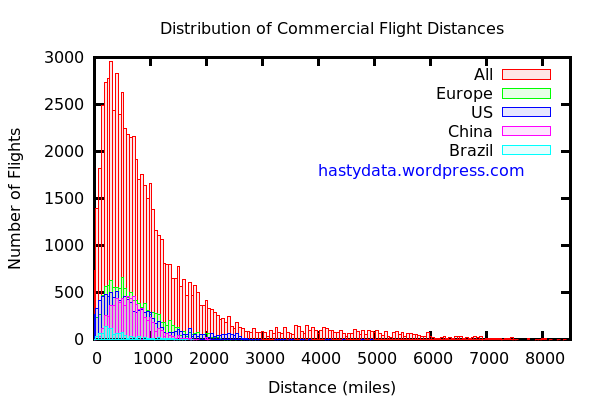

But limitations in battery performance is unlikely to put much of a brake on this new sector for the simple reason that most flights are relatively short. Many routes (especially short helicopter hops, like Nice to Monaco) are well within the range of existing technology. Many more routes will soon be in range as improvements are beginning to be commercialized.

Source: OpenFlights / hasty data 2015

UBER Elevate specification calls for 300Wh/kg for aircraft put into commercial service in 2023, and it has assured its aircraft partners that it is working with battery partners to ensure this can be achieved. With the current growth of the terrestrial EV market, there is no lack of focus on improving batteries. Additionally, new chemistries, such as solid-state lithium (Bolloré, SAFT and others), lithium metal (Pellion Technologies for example) and lithium sulphur (Oxis Energy) are beginning to be commercialized. Oxis Energy recently announced a 450 Wh/kg cell, and funding for a factory to build them in Brazil. Even though battery technology remains in flux and certification challenges remain, it is unlikely that batteries will constrain the development of at least short-haul electric flight.

Other Forces at play

What’s really driving electric aviation and the market for “flying cars” and electric airplanes?

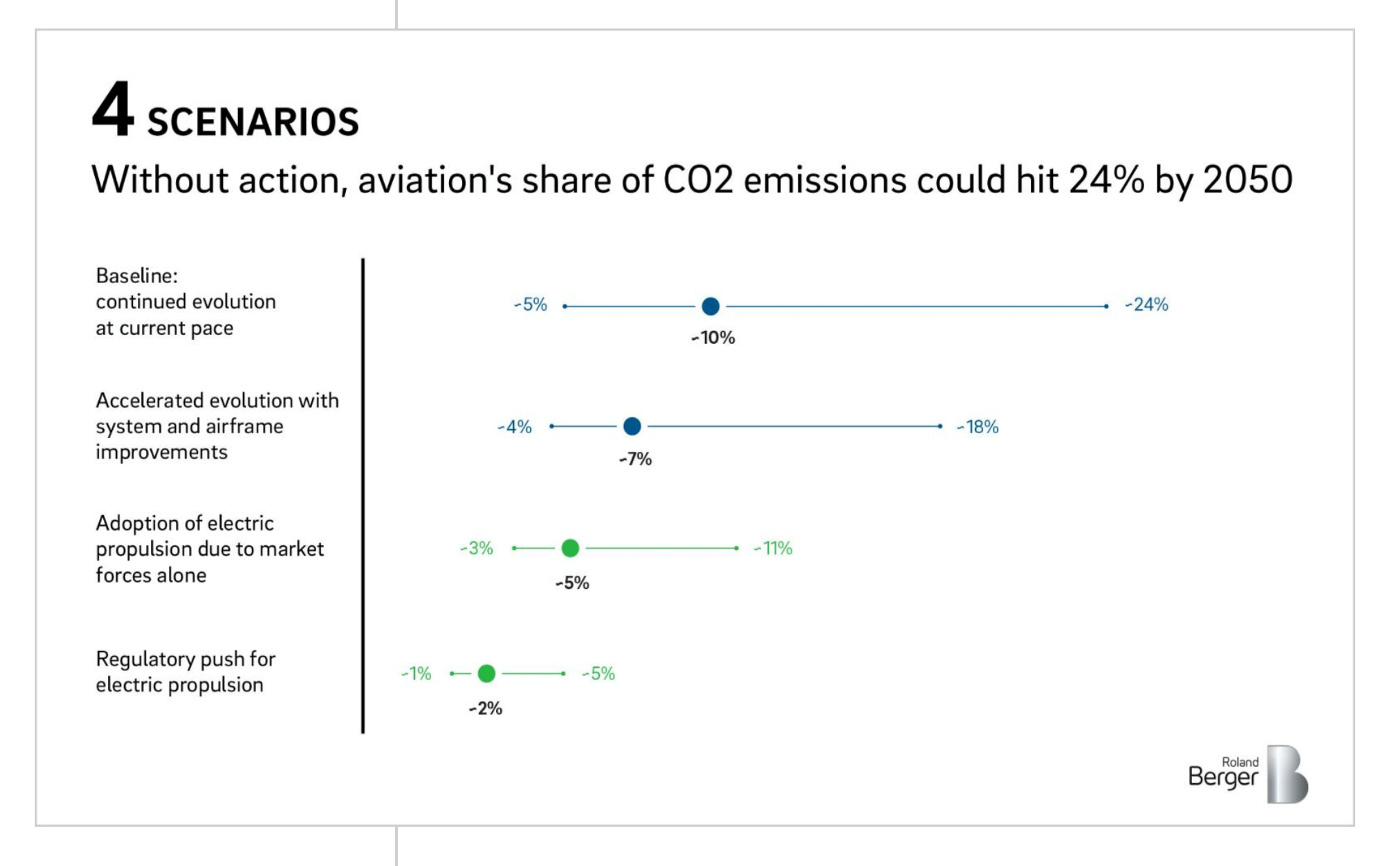

1) Environmental concerns. The initial impetus for electric aviation came from the “Green Flight Challenge.” Although the industry incumbents try to make light of it and claim that aviation accounts for merely 2% of global greenhouse gas (GHG) emissions, most observers agree that it’s one of the fastest growing sources of GHG. Many suspect that the 2% figure is a very significant under-estimate, especially if the warming effect of contrails are taken into account. The carbon footprint of commercial aviation has long been a pet-peeve of environmentalists and some have even vowed to stop flying completely, or at least severely limit it. A “shame of flying” or flygskam has entered into the public consciousness in Sweden to the point that domestic air travel demand declined in 2018, with a commensurate increase in demand of intercity train travel. Governments are beginning to respond to these concerns; the Norwegian government has mandated all-electric domestic flights by 2040. Environmental concerns may also become a key driver for the deployment at scale of cargo and delivery drones.

Source: Roland Berger

2) The flying car fantasy. No one likes getting stuck in traffic and if a similarly priced alternative is available, as promised by the likes of UBER, what is there not to like?

3) The promise of “distributed aviation” and regional air taxi services. The mega-hub system is designed to serve the operational efficiency of airlines flying large fossil fueled aircraft. Many people (in mature developed economies) live within a few miles of a local airfield, and their final destination is within a few miles of a local airfield. Regional aviation has been constrained by high costs and noise. If both of these constraints are removed, a renaissance in regional aviation may ensue.

4) Cargo drones are paving the way for eVTOLs. Easily accepted by society initially for the enhanced delivery of emergency medical services and transport of medical samples, it will be a small step to introduce air ambulances, especially if they are quieter and less costly than existing helicopters. Similar acceptability will be found for fire-fighting. As functional drones are normalized, last mile delivery is likely to become more acceptable, especially if lower carbon footprints can be demonstrated.

Turbulence

Let’s assume that incremental improvement in batteries is sufficient to economically serve short urban/suburban and even regional routes.

What could still prevent this market from emerging at scale anytime soon?

1. Noise — all of the new market entrants are promising quieter aircraft, sometimes much more quiet than existing ones. If this benefit does not materialize, public acceptance for new airport facilities and increased usage of existing ones may prove to be very difficult.

2. Costs — as with noise, everyone is promising a big reduction in costs, especially in operating and maintenance costs. While it’s clear that “electric” fuel is usually less expensive than the hydrocarbon equivalent, it may not be the case in all refueling locations. Also, battery life for this new application remains uncertain, and they may need to be replaced more often than anticipated.

3. Infrastructure — many new infrastructure elements need to be put into place for this industry to emerge, including the obvious “vertiports” for flying taxis, but also the electrical charging infrastructure. According to some estimates, even a modest recharging facility at an airport will require a doubling of existing electrical power availability. Existing air traffic management systems will need to be upgraded or supplemented to accommodate increase traffic, and traffic flying in new corridors. Who will pay for these infrastructure elements remains to be seen.

4. Certification — it goes without saying that safety is of paramount importance. Commercial air transport has an exemplary safety record, and it’s highly unlikely that standards or passenger expectation will be lowered. Certification bodies face major challenges to evaluate and certify new technologies, and are likely, given recent events surrounding the 737MAX, to be overly cautious.

5. Pilots — a renaissance in regional aviation and the emergence of ultra-short-haul eVTOLs will require a significant increase in licensed pilots. Certification agencies also need to adapt licensing to accommodate the new technologies of eVTOLs and electric propulsion. Autonomous systems can overcome this constraint, if and when certification and regulatory authorities agree.

Paradigm shift or not, the race is on to build and deploy these new electric aircraft. Long term success will depend on how well and how quickly market participants navigate through these areas of turbulence.

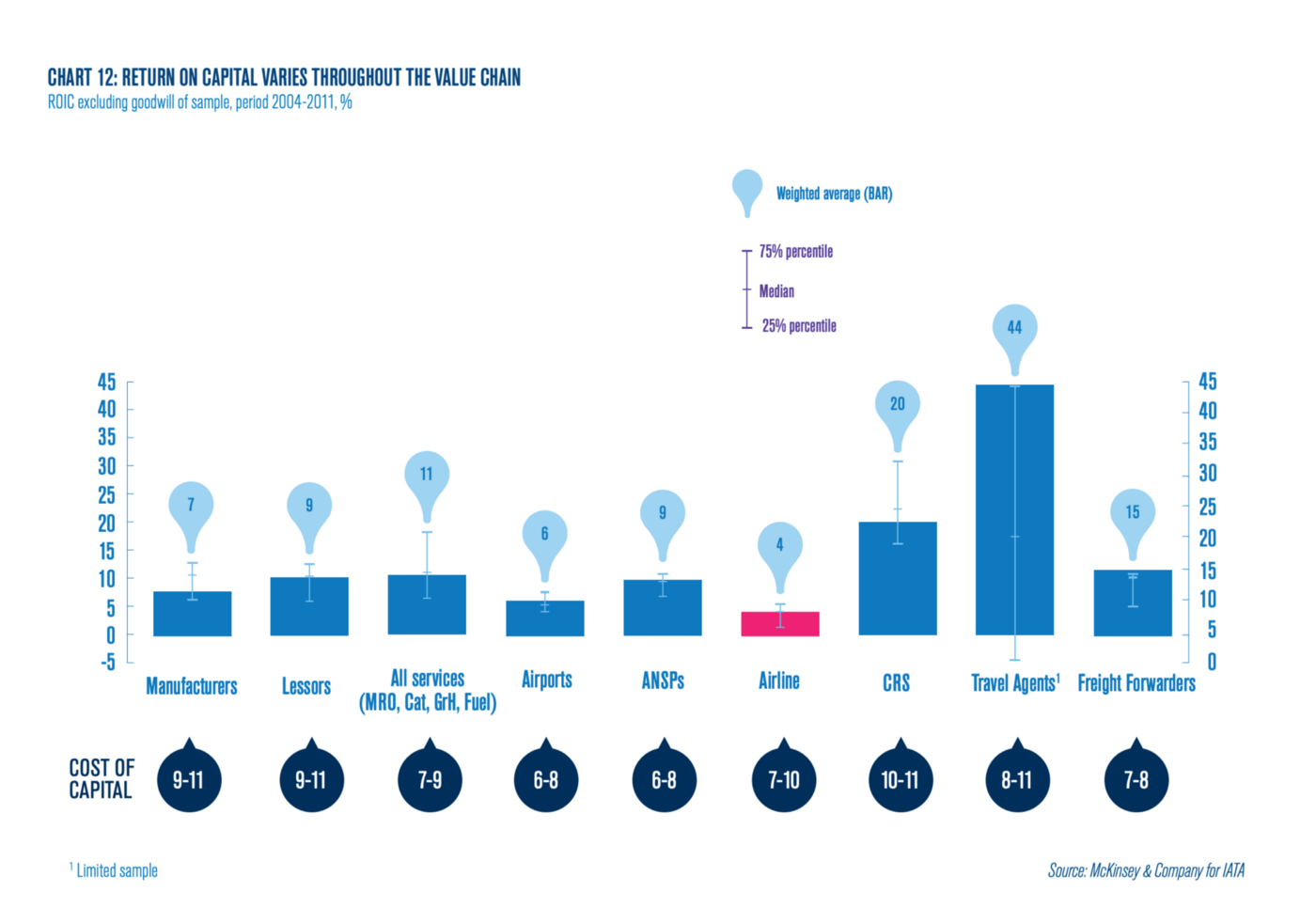

For investors, deciding where to place bets is challenging. Let’s first consider who makes money in aviation today; the most profitable links in the air transport industry value chain are the ticket sellers and the computer reservation systems. This throws an interesting light on UBER’s positioning in the industry. Other attractive segments include all freight forwarders, navigation and other services provided to the airlines.

To what degree this value chain holds in the transition to an electrified industry remains to be seen, and a big question hanging over the sector is: who is going to take the risk to purchase, finance, insure, and operate these new aircraft?

Attractive investment themes in electric aviation

Aster has been investing in early and growth stage innovators driving industry transformations for the past 20 years. We’ve developed a number of investment themes in electric aviation and urban air mobility which leverage and complement our existing investing activity in mobility, energy and industry. Our main themes in aviation include:

· Ticket sales and computer reservation systems. There is already a brisk business in fractional ownership and reselling capacity on private aircraft, including helicopters.

· The supply chain of the new aircraft manufacturers — batteries, battery management systems, electrical control systems, motors; avionics, sensors, navigation aids, autonomous pilot systems. High fidelity design tools for electric propulsion.

· Infrastructure and services — including vertiports, warehouses for delivery drones, air traffic management systems, battery charging, maintenance.

· Cargo and delivery drones — buoyant existing market for equipment and services, fewer regulatory constraints.

· Aircraft manufacturers — rigorous assessment of management and technical teams required, as well as technical review of design concept and execution capability. Entry barriers seem deceptively low; many start-ups will hit the wall as they attempt to undergo certification of their aircraft.

Paradigm Shift?

We most probably are in the midst of a paradigm shift: the underlying assumptions about the air transport industry may no longer hold. Market entrants arriving with new technologies present both challenges and opportunities for the incumbents. Airport planners and civil aviation authorities need to consider that growth may also come from regional airports rather than just mega-hubs. Cities and regions need to consider the benefits and risks of introducing urban air mobility and cargo drones. For the old guard a paradigm shift represents both threats and opportunities: existing airlines may be surprised by how quickly new entrants begin to erode the edges of their already fragile businesses.