The energy retail market, often perceived as slow-moving, is evolving quickly in France. Start-ups are leading innovation into new business models, new services and customer engagement strategies, questioning EDF’s historical hegemony. The future looks full of new challenges and opportunities, for both new entrants and more established players.

The Nuclear Paradox

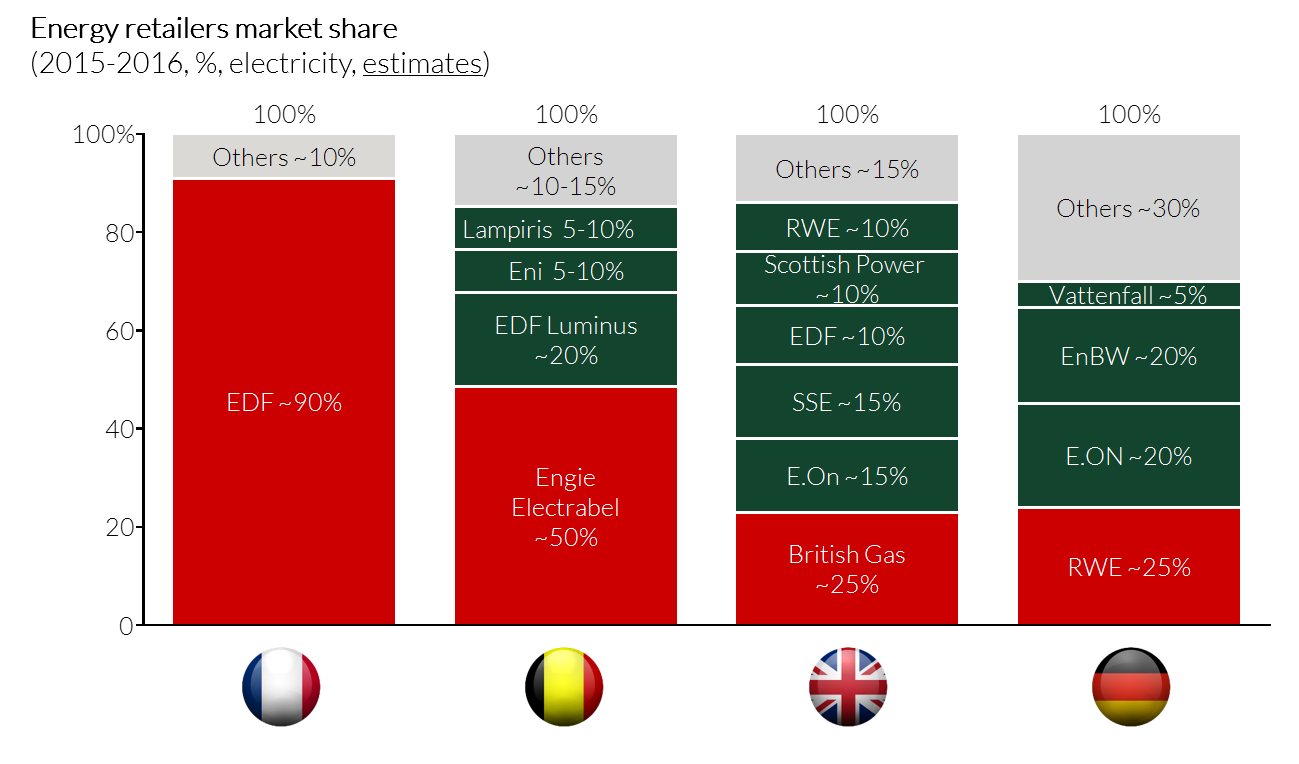

Deregulation of the French residential electricity market — fostered by various EU Directives — was fully completed in July 2007. Since then, 31 million customers can freely select their electricity provider, and are no longer required to contract with EDF, the French historical electricity producer and retailer. 10 years later however, it must be noted that EDF still holds a 90% market share on the electricity retail market and faces weak competition. Direct-Energie, EDF’s biggest and better-known competitor (mainly thanks to sizeable marketing campaigns created to educate the market on deregulation), today powers less than 2 million meters — still far from threatening EDF hegemony.

Other EU countries adopted similar national regulation in their respective domestic markets in the 2000s. In Belgium, Germany of the UK for instance, competitive landscapes now look much less concentrated than in France, with a few players capturing a 10–20% average market share each.

Certainly, the French market deregulation occurred later than in Germany, the UK or Belgium. Yet, we believe market conditions are more and more favorable for the French market to follow its neighbors’ lead — but why now?

Why now?

The opening of the retail electricity market will accelerate in the next few years due to the convergence of two main drivers:

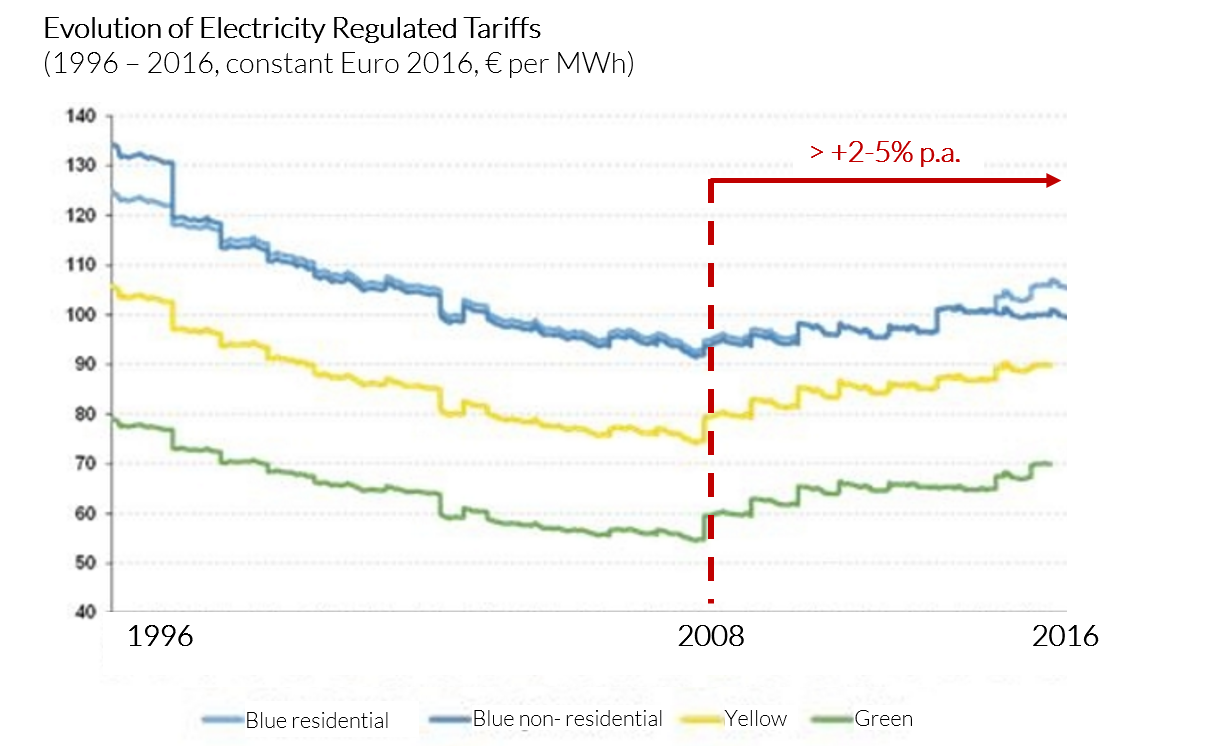

1. As Regulated electricity retail prices (TRV) keep on increasing, customers are looking for more competitive deals

Surprisingly enough, Regulated Tariffs charged by EDF have been steadily increasing by 2–5% per year since 2008 depending on customer consumption profile. Some increases in price can even occur retroactively: this summer €1bn were charged back by EDF to customers for a somehow illegal freeze in price in 2014–2015. At the same time, in a context of difficult economic conditions and high unemployment rate, switching to a new energy provider is becoming a mainstream “quick-win” option for households. It could yield savings up to a few hundred euros per year. Recent surveys show than more than 70% of customers switching to a new energy provider are primarily looking for more competitive offers.

Historically churn rate on the electricity market has been lower than gas. In 2016, for example, churn was 4% in the electricity market compared with 9% in gas. While this may appear limited, it represents a sizeable opportunity to capture more than 1.3m electricity meters per year. In other words, the French market could theoretically create a new Direct-Energie every year! In practice, things are slightly different: Direct-Energie is growing fast and captures a sizeable proportion of churners, while other players fiercely compete to capture customers that are less price sensitive and/or enticed with other value proposition components (e.g., green energy, etc.)

In a market where customers are looking for more transparency of information, intermediaries (aggregators like JeChange.fr, Souscritoo, Selectra and Group Sales like UFC-Que Choisir) have positioned themselves as a strong and cost-effective new customer acquisition channel for most retailers and are likely to get a more and more important role in the future.

“There is already a potential to create a new Direct-Energie every year”

2. Financial incentives for smaller players facilitate emergence of new offers

Several financial incentives have been developed by regulators during the past few years to accelerate market opening and induce new players and new business models into entering the market. They include:

- Direct Subsidies — For each energy retailer with less than 1.75m meters, Enedis (ex-ERDF) would grant €30/year/meter for 3 years to cover part of the costs related to the integration with their IT back-end

- “Bad-payers” costs — These costs are now partially supported by both energy retailers and distributors (vs. historically 100% supported by retailers)

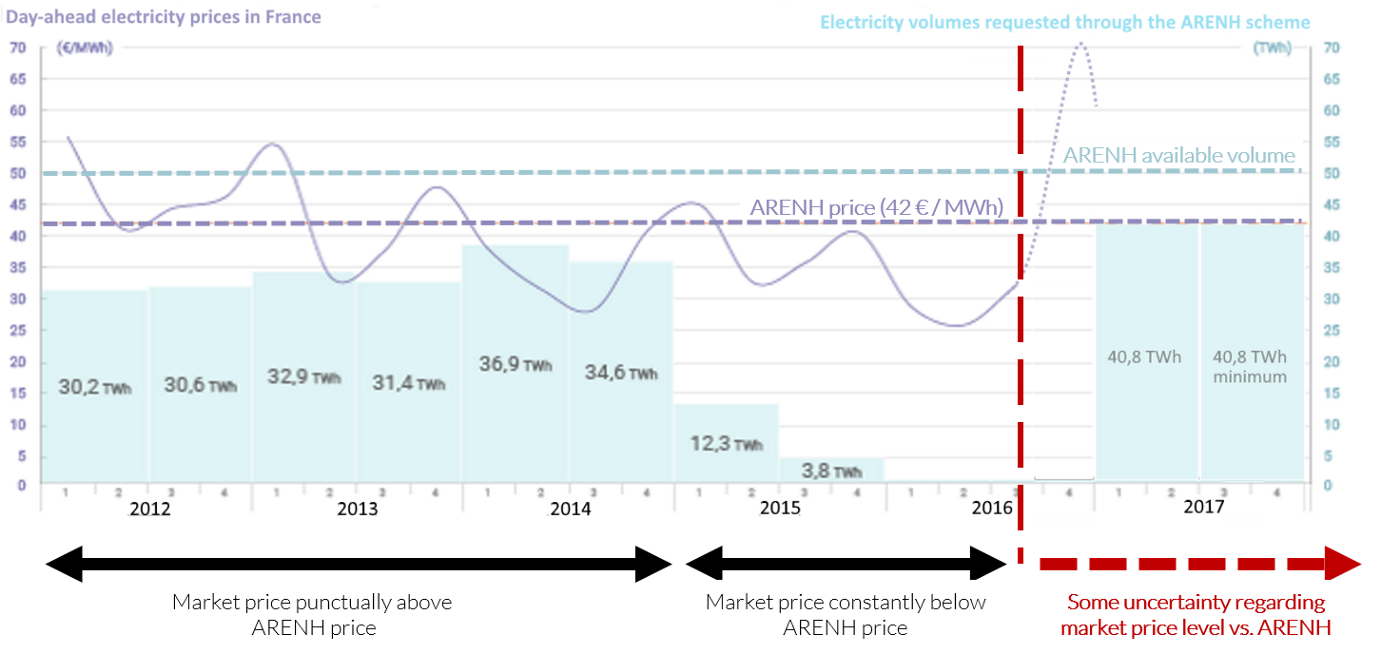

- Access to ARENH energy — Any retailer can have access to EDF nuclear energy at a fixed price of €42/MWh. This allows small retailers to hedge against market Spot price increase, which can show strong volatility (related to operating status of EDF nuclear plants or winter temperatures for instance). Used cleverly, the ARENH scheme provides a real security of supply for small retailers until they reach a critical size of approx. 50k meters. At that point, retailers are managing a large enough quantity of energy to efficiently forecast demand and plan purchasing strategy accordingly. ARENH access is limited to 100 TWh in cumulated volume. This is sizeable (20% of France total yearly consumption) and has historically always been undersubscribed by electricity retailers, even in periods when market prices were often above ARENH price.

“Used cleverly, the ARENH scheme provides a real security of supply for small retailers, until they reach a critical size of ~50k meters”

A new competitive landscape — who will survive?

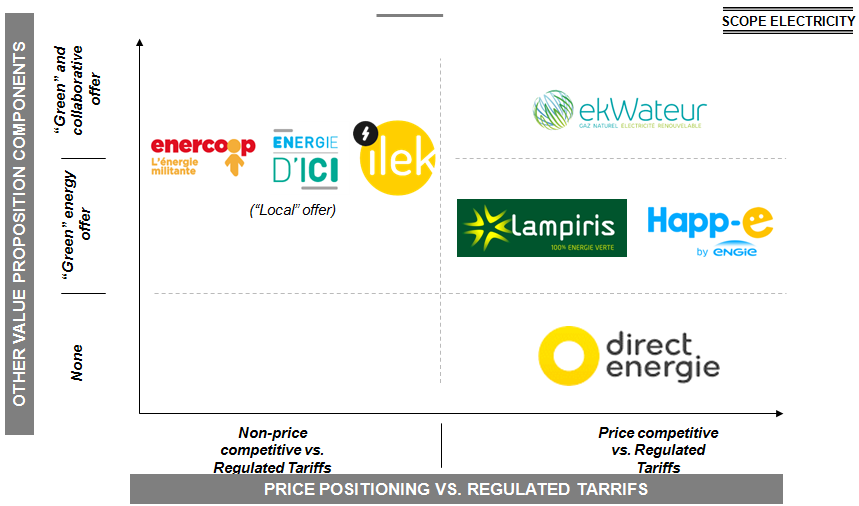

In this context, alternative players have entered the market (and more and more will probably do in the future) with an ambition to differentiate themselves from EDF and capture as many churners as possible. As expected, most new players compete on price and offer a 5 to 10% discount vs. Regulated Tariffs, while those who don’t are very unlikely to succeed in building a sizeable portfolio of customers. In addition to price, new entrants also try to improve the value proposition to the end-customers by offering green (solar, wind, hydro), locally-sourced and/or collaborative energy, with mixed success to date.

Gross margin on pure energy retail business is constrained by sizeable fixed costs (taxes, transport cost, etc.) and don’t exceed 5–10% of sales. This leads to two main “must-have” achievements for alternative players to survive:

- Mandatory critical mass (>50–100k meters) must be reached quickly for new entrants to cover fixed costs, improve energy consumption forecast and build effective procurement strategy accordingly, and achieve independence from ARENH. Not all players will be able to do it fast.

- Development additional services should be a cultural mandate for all new entrants. These can include insurance products, boiler installation / maintenance, trusted intermediary (market place) for household energy efficiency investments (insulation, solar, smart thermostats, etc.) and other premium services. In addition to improving customer stickiness and generating actionable customer date for retailers (e.g., smart home devices), they should become a strong margin contributors and change electricity retailers “traditional” P&L.

“Quickly reaching a critical size and effectively selling additional high-margin services are two “must-have accomplishments” for new entrants”

Within a 5 to 10-year period, successful new players will all be cheaper than Regulated Tariffs, and will differentiate from one another with alternative energy supply offers and/or innovative additional services.