“Silicon Valley wants more water start-ups” highlights a recent CNNMoney interview. Indeed, the number of water start-ups is considerably increasing -with the majority coming from North America, Europe and Israel-, introducing both breakthrough and incremental technologies that will undoubtedly disrupt the way water resources and services are managed.

Technology-wise, the two main sectors which have seen the most innovation are industrial water and wastewater treatment — with technologies that can save CAPEX and OPEX, in particular energy costs — and the introduction of digital technologies and services for water infrastructure and water quality management. The third one to watch is desalination. Higher performance membranes and alternatives to reverse osmosis are in development and will soon be commercialized at scale. These shall give a different perspective to this resource !

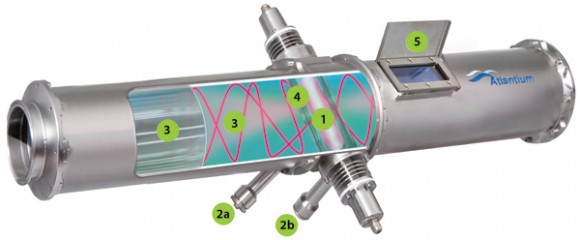

An example of a product by the Atlantium Technologies company, which aims to provide industry and municipalities with safe and sustainable water treatment solutions. The company has designed an innovative solution based on UV (ultra violet) disinfection, fiber-optics and hydraulics. It takes water safety to levels never before achieved with other UV systems or without chemicals. Aster first invested in 2013.

Start-ups range from early stage companies to research projects that can bring a real breakthrough in the sector and respond to an identified market need. It is important to create a long-term connection, be proactive and relevant in a sector which has historically been slow to embrace innovation. It is equally critical to acknowledge that in 90% of the cases, the technology is innovative, and the challenge is rather to bring a new economic and business model that will make the case profitable in the short-run. Partnering with incumbent companies can notably be a pre-requisite, but not exclusively.

Disruptions will be in technologies AND in the business models

Innovative technologies brought to the market by the start-ups will definitively disrupt the economic and business models applied in the water and wastewater sectors so far. Water start-ups have understood that both are important to be competitive. New business models will, for instance, consider ‘the technology as a service’: technology is scalable faster, and can be adapted to the industry’s needs. The industrial end-users will then look with a different perspective at CAPEX and OPEX for water management.

Start-ups are also building on prospects and opportunities brought forward by other technological areas. Boundaries between sectors are progressively being blurred : let’s take 3 examples:

Energy — the development of renewable energy has opened considerable perspective for improving access to water in those areas where it has been too complicated and costly to build infrastructure. For example, we are seeing decentralized solar-based water and wastewater solutions coming onto the market. The challenge being still around the cost of produced water. Conversely, the cost of energy for advanced technologies should soon no longer be an issue. Energy efficiency and energy recovery are at the core of the many innovations: these do not only concern wastewater treatment plants, which are increasingly becoming carbon-neutral and/or energy-positive.

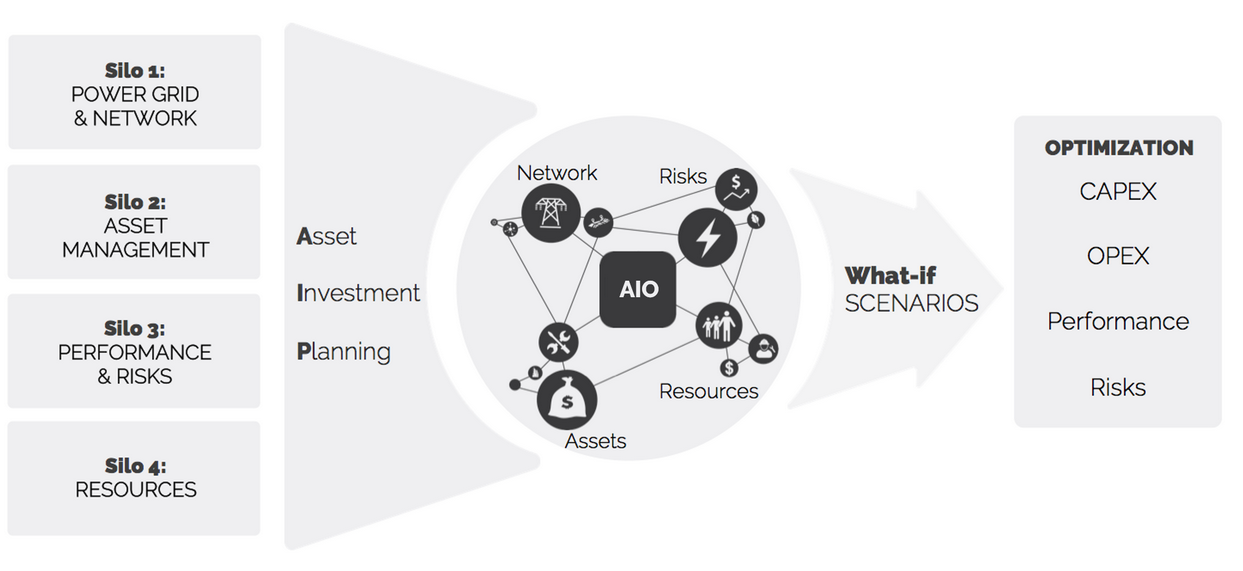

Digital — Many publications have already done excellent analysis, and the focal point here is that ‘non-water’ digital start-ups positioned on utility markets see water as an opportunity. The solutions developed by those start-ups can easily be transferred to the water sector, and bring a different integrated approach to resource management.

Circular economy — Turning wastewater into a resource is not new. However, using wastewater in unexpected sectors is innovative, like in transport (to produce hydrogen to power electric cars) and in the battery industry (to use brewery wastewater into energy storage cells). Materials in batteries have also inspired the development of a new desalination technology, still early stage today, yet with a huge market potential in the future.

There are many more examples, such as block chain applied to water, carbon recycling for membrane coatings, and application of 3D printing to treatment technologies. The revolution 4.0 in water should be inspired by these examples: cross-fertilization between sectors is very enriching and should really be encouraged.

The missing link is still finance

Despite massive research programs from all levels of government in different parts of the world, there is still a disconnect in the world of water between academia and the actual implementation of the research results on the field. When everyone agrees on the importance and on the economic potential of the water market, investment remains still low. And when it is said that investments are too small, we all should remember that this was the case with computer and software companies in the 1970/80s.

There is a reality out there, at least in Europe, that municipal markets are much more reluctant to go for innovations. The low price of water and the historical risk-adverse culture to innovation are still major hindrances. The introduction of the ‘Smart City’ concept, and the new EU public procurement rules are opening new options to encourage innovation without hampering competition and transparency. The EU Procurement Directive adopted in 2014 introduces Innovation Partnerships as a new procurement procedure. One will have to see how these will concretely be put into practice in the future. One key aspect: EPC contractors will be critically instrumental for a successful implementation.

This year will certainly see another wave of M&As in the water sector. And consolidation might be necessary at some point. In the meantime, there are many developments that should transform the actual landscape from rather conservative to innovative and dynamic. The future should be built on the different above mentioned elements, on the greater noticeable interest from large companies in innovative start-ups, on the growing awareness that existing technological solutions will be limited to address emerging quality and quantity challenges. The imperious needs to optimize costs, and the opportunities brought about by emerging markets can also be added. Finally, new technologies will create new markets. This is already happening in energy.